A version of this article appeared in the Dallas and Denver Business Journal on October 7, 2024.

On March 28, 2025, the SEC announced that it would no longer defend its March 2024 climate-related disclosure rule against legal challenges. The rule had previously been stayed pending resolution of these legal challenges.

The SEC had previously adopted the final rule on mandating registrants to disclose climate-related information in their registration statements and annual reports on March 6, 2024.

Initially proposed on March 21, 2022, the final rule differs in several ways, including changes to financial statement footnote disclosures and reductions in the scope and number of registrants subject to greenhouse gas (GHG) emission disclosures.

Organizations must understand the updates as they navigate complexities of the requirements, assess their potential impact, and implement necessary changes to their reporting processes.

Learn more about:

- Recent updates

- What you need to do to prepare

- Who is affected

- What the materiality qualifier is

- S-X—financial statement footnote disclosures

- What climate-related risks are

- S-K disclosures—outside the financial statements

- Safe harbor requirements

- Location, period required, and timing

- Questions to ask

Recent Updates

On February 11, 2025, Acting Chairman Mark Uyeda directed SEC staff to request the court delay scheduling the case for argument to provide time for the commission to deliberate and determine appropriate next steps.

The SEC had voluntarily stayed the final rule on April 4, 2024, pending judicial review of all legal challenges. The stay doesn’t reverse or change any of the final rule’s requirements. The outcome of the litigation is unknown, and the review may take several months or longer. It’s uncertain whether the SEC will retain or extend the final rule’s current compliance dates.

What Do You Need to Do to Prepare?

Regardless of regulatory compliance and legal challenges, identifying climate-related risks, understanding your carbon footprint, and having an overall ESG strategy is beneficial to your organization.

Understand Applicability

Understand other ESG regulatory compliance applicability. Understand what other ESG regulations may be applicable to your organization, such as California’s SB-253, SB-261, or the European Union’s Corporate Sustainability Reporting Directive (CSRD). It’s important to plan holistically for ESG regulations as disclosure requirements differ in GHG emission scopes, materiality thresholds, and reporting standards for each regulation.

Conduct a Climate Governance Assessment

- Train and educate board, management, and employees about the final rule

- Enhance board and management oversight, and define clear roles, responsibilities, and charters

Assess Current State of Climate Data

- Assess existing or disclosed climate data, including examining processes and controls over climate data

- Identify disclosure and control gaps related to data, controls, and reporting

- Understand resources needed for meeting reporting deadlines based on people, processes, and systems in place

Conduct a GHG Emission Reporting Readiness Assessment

If applicable, prepare for attestation and conduct a GHG emission reporting readiness assessment. A GHG Reporting Readiness Assessment is an independent evaluation used to determine your preparedness to effectively measure, manage, and report on GHG emissions prior to seeking an assurance opinion. It involves assessing the documents, data, policies, calculations, and calculation methodologies in place to support the in-scope reporting disclosures.

Who Is Affected?

Essentially all domestic and foreign registrants, except for asset-backed issuers, must provide Scope 1 and Scope 2 GHG emission disclosures. Smaller reporting companies (SRC), emerging growth companies (EGC), and nonaccelerated filers are exempt from Scope 1 and Scope 2 GHG emission disclosure requirements but must provide all other disclosures.

What Is the Materiality Qualifier?

The final rule relies on the US Supreme Court’s definition of materiality and states “a matter is material if there is a substantial likelihood that a reasonable investor would consider it important when determining whether to buy or sell securities or how to vote or such a reasonable investor would view omission of the disclosure as having significantly altered the total mix of information made available.”

While determining how to respond to the final rule, registrants should think about materiality through the lens of this definition. Similar to how registrants think about materiality related to their management discussion and analysis (MD&A) section, registrants will need to apply a reasonably likely standard when evaluating their disclosure requirements.

S-X—Financial Statement Footnote Disclosures

There are also certain financial statement disclosures that are subject to specific thresholds.

Severe Weather and Other Natural Conditions

Certain financial statement effects of severe weather events and other natural conditions are required to be disclosed in the notes of the financial statements, regardless of whether such events were caused in whole or part by climate change.

The financial statement footnote disclosures are broken down into two categories:

- Income Statement Effects. Capitalized costs, expenditures, charges, and losses incurred as a result of severe weather events and other natural conditions if the amount equals or exceeds 1% of the absolute value of income or loss before taxes for the relevant fiscal year—unless the amount is less than $100,000.

- Balance Sheet Effects. The disclosure of capitalized costs and charges is required if the amount equals or exceeds 1% of the absolute value of stockholders’ equity or deficit as of the end of the relevant fiscal year—unless the amount is less than $500,000. Please note the SEC doesn’t define severe weather events or other natural conditions in the final rule. Instead, the SEC provides a non-exhaustive list of examples, such as hurricanes, tornadoes, flooding, drought, and wildfires. Registrants must develop an accounting policy and exercise judgment to determine what qualifies as a severe weather event or other natural condition.

Carbon Offsets & Renewable Energy Certificates (RECs) Information

Registrants are required to disclose capitalized costs, expenditures expensed, and losses related to carbon offsets and RECs if used as a material component of a registrant’s plan to achieve its climate-related targets or goals.

The SEC defines carbon offsets and RECs in the final rule as follows:

- Carbon Offset. Carbon offsets represents an emissions reduction, removal, or avoidance of GHG in a manner calculated and traced for the purpose of offsetting an entity’s GHG emissions.

- RECs. Renewable energy credit or certificate means a credit or certificate representing each megawatt-hour (MWh) of renewable electricity generated and delivered to a power grid.

Estimates and Assumptions

If financial statement estimates and assumptions are materially impacted by risks associated with severe weather events and other natural conditions—or any disclosed climate-related targets or transition plans—a registrant is required to disclose a qualitative description of how the development of such estimates and assumptions were impacted.

Note that financial statement footnote disclosures will be subject to existing financial statement audit requirements and management’s internal control over financial reporting (ICFR).

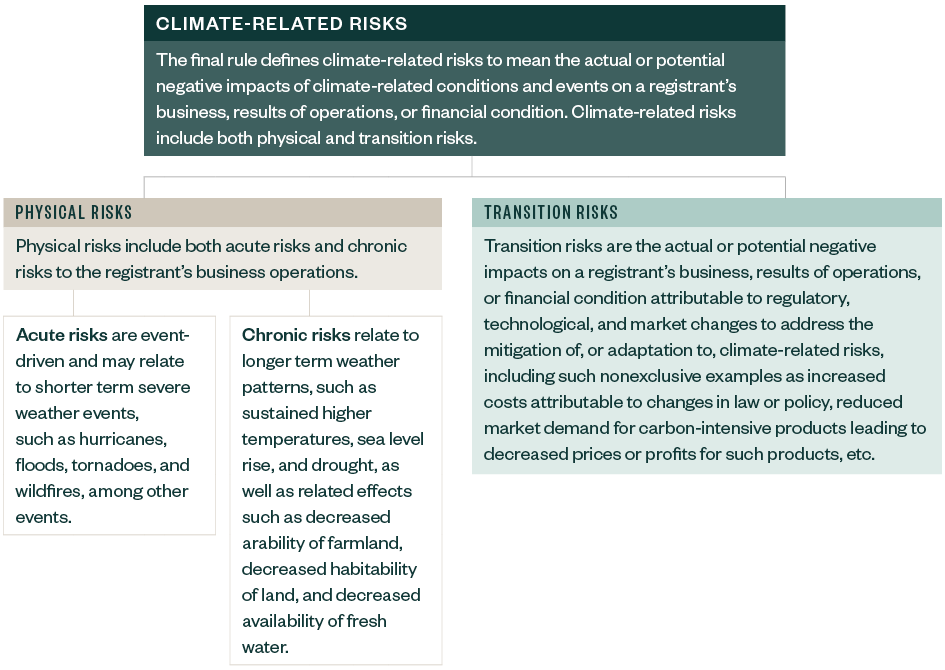

What Are Climate-Related Risks?

Below are key definitions of what qualifies as climate-related risks.

Key Definitions to Understand

S-K Disclosures—Outside the Financial Statements

The following sections include a summary of the rule’s S-K disclosure requirements.

Governance Disclosures

Any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the registrant’s material climate-related risks. Registrants must provide information on board of directors’ oversight and management oversight.

Board of Directors’ Oversight

The board of directors’ oversight of climate-related risks includes:

- Any board committees or subcommittees responsible for the oversight of climate-related risks

- How the board is informed about climate-related risks

- How the board manages progress toward climate-related targets, goals, or transition plans

Management Oversight

The management oversight in assessing and managing material climate-related risks includes:

- The management roles or committees responsible for climate efforts and their relevant expertise

- The processes to assess and manage climate-related risks

- Whether management reports climate-related risks to the board

Strategy

Climate-related risks that have had or are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition.

This includes the following disclosures:

- Climate-related risks include physical, acute or chronic, and transition risks

- Timing of risks and whether risks are expected to occur in the next 12 months and in the long term beyond the next 12 months.

Registrant Activities

Specified disclosures regarding a registrant’s activities to mitigate or adapt to a material climate-related risk, including the use of climate transition plans, scenario analysis, or internal carbon prices, if any.

- Climate transition plan. Description of a registrant’s climate transition plan and progress over time if registrant has adopted such a plan.

- Scenario analysis. A description of the scenarios, assumptions, and projected financial impacts if a registrant uses scenario analysis to assess its business in the context of climate-related risks and concludes that such risks are reasonably likely to have a material impact.

- Internal carbon price. Price and other information if a registrant uses an internal carbon price and this use is material to how it evaluates climate-related risk.

Targets and Goals

Information about a registrant’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition.

If deemed material, registrants will need to disclose the following:

- Full scope of activities

- Projected time horizon

- Baseline for tracking progress

- Plans for achieving targets or goals

- Annual update on progress towards targets or goals and how such progress has been achieved

- Carbon Offset of Renewable Energy Credits or Certificates (REC) if material to plan to achieve climate-related targets or goals

Note registrants must disclose information about their publicly announced or internal climate-related targets or goals it they materially affect or are reasonably likely to materially affect the business, results of operations or financial condition.

Risk Management

The registrant’s processes for identifying, evaluating, and managing material climate-related risks and whether those processes are integrated into its broader enterprise risk management program.

Disclosures include:

- Whether a material physical or transition risk has been incurred or is reasonably likely to be incurred

- Determination of how management responds to identified risks, including whether to mitigate, accept, or adapt to a particular risk, including whether management decides to prioritize addressing the identified material climate-related risk

Material Expenditures and Impacts

Quantitative and qualitative description of material expenditures and impacts on financial estimates and assumptions that directly result from:

- Activities to mitigate or adapt to climate-related risks

- Disclosed transition plans

- Disclosed targets or goals or actions, or the actions taken to progress or reach them

The SEC climate disclosure final rule accommodates an additional year to comply with these requirements as there may be circumstances in which registrants need to implement new systems to further develop their processes and controls to appropriately track and report their material expenditures and impacts associated with climate-related risks related to the above bullet points.

GHG Emission Disclosures, Required if Material

Below is an overview of GHG emission disclosure requirements applicable only to large accelerate filers (LAF) and accelerated filers (AF) other than SRCs and EGCs:

- Scope 1. Direct GHG emissions from operations that are owned or controlled by a registrant.

- Scope 2. Indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat, or cooling that is consumed by operations owned or controlled by a registrant.

Compared to the proposed the rule, registrants in the final rule are able to establish their organizational boundaries related to their GHG emissions reporting. However, registrants are required to disclose if their organizational boundary materially differs from the entities and operations reflected in the consolidated financial statements.

Safe Harbor Requirements

The final rule provides a safe harbor for disclosures related to transition plans, scenario analysis, internal carbon pricing, and targets and goals, other than disclosures about historical facts, this includes IPO transactions, to protect registrants from liability. See SEC Finalizes Disclosure Rule for more details.

Location, Period Required, and Timing

The following information is related to the location and timing of the final rule’s climate disclosures.

Location

Registrants must provide disclosures in annual reports at the time of the filing.

S-K—Nonfinancial Statement Footnote Disclosures

Other nonfinancial statement disclosures, including GHG emissions:

- Domestic registrants must disclose in a newly created section of Form 10-K (Item 6) immediately before MD&A or in another appropriate section of the filing, such as risk factors and MD&A.

- Foreign private issuers must present it in Form 20-F (Item 3.E).

Registrants should consider providing a cross-reference to the disclosures in Item 6 or Item 3.E, as applicable, if they are presented in a different section of the filing.

GHG Emission DisclosuresGHG emission information disclosure:

- Domestic registrants may elect to disclose their annual GHG emissions within their 10-Q (Item 1.B) for the second fiscal quarter of the following year.

- Foreign private issuers may provide their GHG emission disclosures in an amendment to their annual report on Form 20-F due 225 days after the end of their fiscal year.

Period Required

- Disclosures must be included for the same period presented as the audited financial statements reflected in the filing.

- For IPO filings, provide disclosures related to the most recent year’s audited financial statements.

Timing

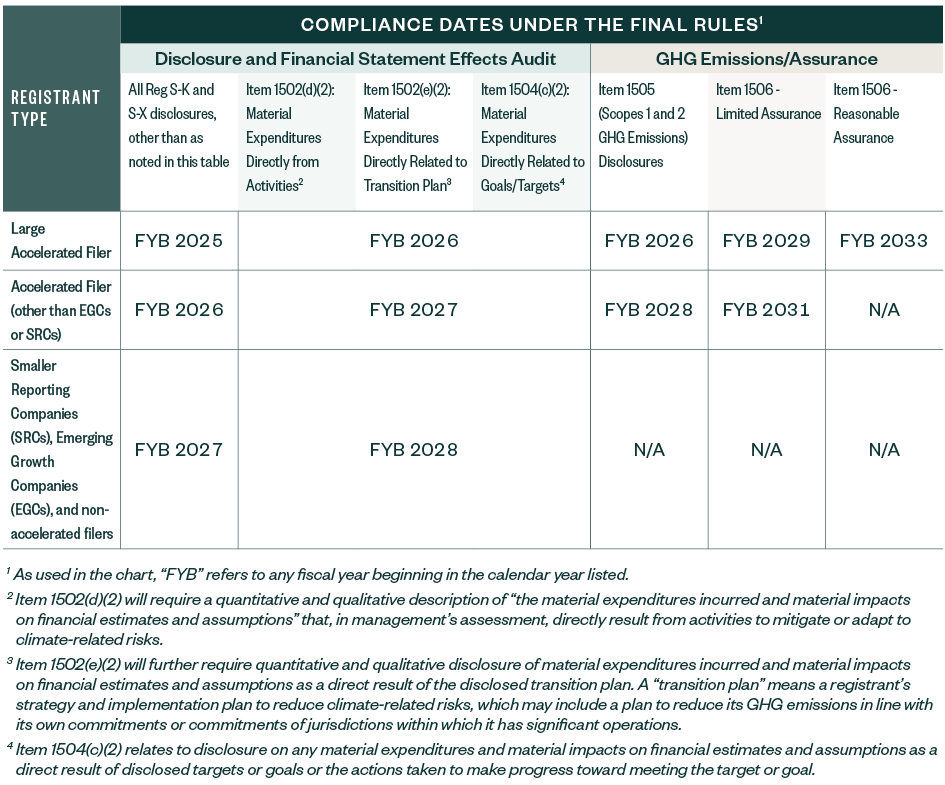

The following are compliance dates under the SECs climate disclosure final rules.

Questions to Ask

- What are your climate-related risks?

- What are your physical risks? What are your transition risks? Are they material?

- How have these climate-related risks materially affected or are reasonably likely to materially affect your business strategy, results of operation, or financial condition?

- How do you provide oversight of climate-related risks? What is management’s role in assessing and managing those risks?

- Do your climate-related target or goals materially affect or are reasonably likely to materially affect your business?

- For LAFs and AFs, are you comfortable with Scope 1 and 2 GHG emissions reporting processes and calculations?

- Are you ready for assurance over your GHG emission disclosures?

- Do you have controls in place to ensure your GHG emissions reporting is complete and accurate?

- Do you have the right processes and systems in place to meet the rule’s reporting requirements?

We’re Here to Help

For help navigating the complexities of the SEC's final rules on climate-related disclosures, contact your Moss Adams professional.